Invoice vs Receipt: What’s the Difference

Knowing the difference between an invoice and a receipt is a key skill in running a successful business. In this article, we’ll take you through the key differences between these two business documents while also touching on the role of receipts in claiming business expenses for tax purposes.

Read on to learn more about the important distinctions between receipts and invoices and how FreshBooks can support you on your business journey.

Key Takeaways

- One of the main differences between a receipt and an invoice comes down to who issues the document.

- In the case of an invoice, it is the party requesting compensation for their services or goods provided who produces the invoice, which typically contains a detailed and itemized list of goods and services provided.

- Once that invoice is paid, that same business will then issue a receipt that displays the full amount the buyer paid for the service or good(s) in question.

- Receipts serve as proof of payment and are required for claiming business expenses.

Here’s what we’ll cover:

What’s the Difference Between an Invoice and a Receipt?

Importance of Invoices and Receipts in Business

Can I Claim Expenses Without a Receipt?

Is an Invoice a receipt?

An invoice is not a receipt and the key difference between the two is that an invoice is issued before payment as a way of requesting compensation for goods or services, while receipts are issued after payment as proof of the transaction. An invoice tracks the sale of a business’s goods or services. A receipt serves as documentation for the buyer that the amount owed for the goods or services has been paid.

What’s the Difference Between an Invoice and a Receipt?

The key differences between an invoice and a receipt are the time at which they’re each issued and the purpose they serve. Here are the main differences between an invoice and a receipt:

- The main difference between an invoice and a receipt is that an invoice is issued prior to a payment being made, and a receipt is issued after a payment is processed.

- An invoice is a request to collect payment issued by the seller, whereas a receipt is proof of payment given to the buyer.

- An invoice is used by businesses to track the sale of their goods and services, whereas a receipt serves as documentation used by the buyer to demonstrate the amount they’ve paid for the goods or services.

- An invoice alerts a client to the total amount due and the deadline to submit payment, whereas a receipt outlines the total amount paid along with the method of payment.

What Is an Invoice?

An invoice is one of the key business documents that every small business owner must learn to read and produce for themselves. Invoices provide a detailed listing of the exact services and goods that were rendered to the purchasing party. They allow a business to begin the process of collecting payment from another business.

While invoices are often fairly standard, they do vary from business to business. What follows is a short list of some of the key listings you might find on an invoice:

- Invoice number

- Date of service rendered

- The date the invoice was sent

- Contact information for the seller

- Contact information for the buyer

- Terms and conditions

- Costs per individual unit for each good and/or service

- Money owed

- Payment terms on invoice

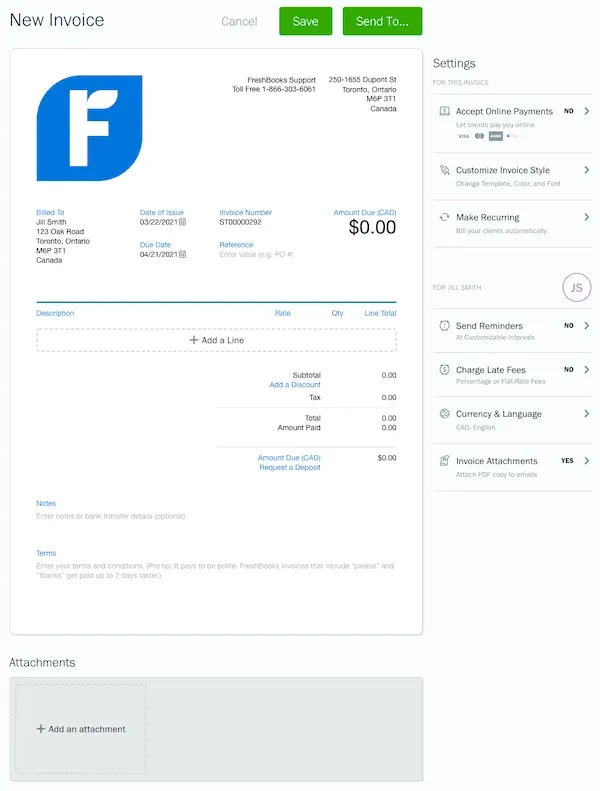

Invoice Example

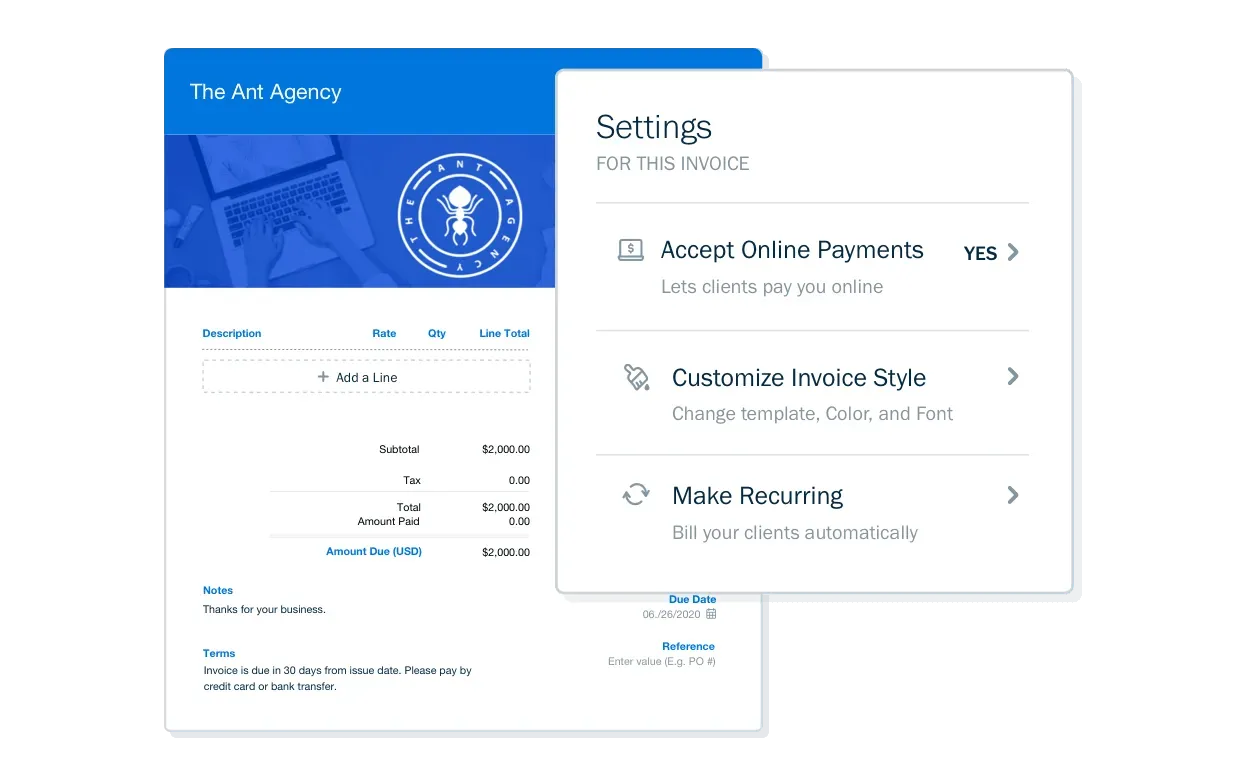

This sample invoice from FreshBooks demonstrates how an invoice differs from a receipt. As you can see, this invoice shows the amount owing on the bill for the specific services rendered and it offers a unique invoice number, as well as the total amount owing and the due date for payment. The service provider will send this invoice to their client as a request for payment.

Looking to bring ease and confidence to your business’s invoicing? Check out FreshBooks online invoicing software that helps you save valuable time through handy automatic payment reminders and simple online payment options for your clients. Click here to start your free trial today and discover the next step forward in your business adventure.

What Is a Receipt?

A receipt is a financial document you receive when you have paid (partially or fully) for a good or service. Receipts can vary quite drastically in the information they provide, but they will always list the total price paid during the transaction. Other pieces of the important information you might find on a receipt include:

- The name of the business

- Business address

- The date of the transaction

- Method of payment

- An itemized breakdown of cost per service and/or good(s)

- Total amount paid

- Sales tax

What Is a Payment Receipt?

A payment receipt also referred to as a receipt for payment, is an accounting document that a business provides its customer as proof of full or partial payment toward a product or service. Payment receipts typically include the following information about the transaction:

- Business name

- Clear identification as a payment receipt

- Reference to the original invoice number

- Date of payment

- Method of payment used

- Amount received

- Amount still owing, if applicable

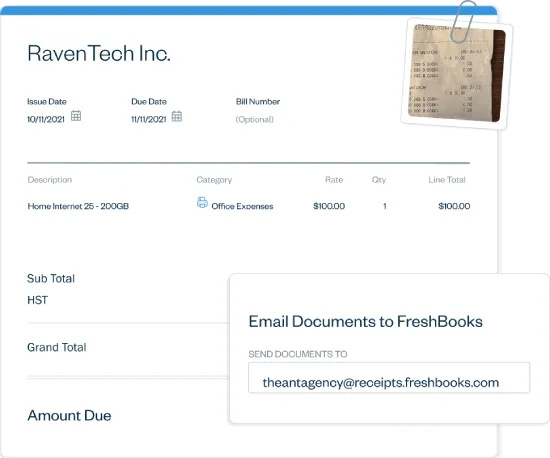

Receipt Example

This sample receipt from FreshBooks shows some key differences between a receipt and an invoice. The receipt shows the amount paid, the date the payment was made, and the method of payment the buyer used. In this example, FreshBooks created the receipt at the time the payment was accepted and offered the receipt to the buyer as proof of the completed transaction.

Importance of Invoices and Receipts in Business

One of the main reasons receipts and invoices are important for all businesses is that they allow for complete and accurate recordkeeping. As receipts and invoices flow towards a business, the owner or bookkeeper will need to add their costs to their running totals for the month and year. This allows the business to maintain a clear overview of its expenses to date.

Effectively tracking invoices and receipts can also save you a major headache during tax season, especially if your business happens to be selected for an audit. Having all of your proof of payments together in one place means that you can easily meet whatever requirements come your way and get back to achieving your core business objectives.

A complete record of business expenses in the form of receipts and invoices can also help you plan your business’s future. You’ll be able to review historical data through its receipts and use that information to create business budgets based on past expenses. This includes finding places to cut costs and negotiate better deals for services.

One last major benefit is the ability for small business owners to claim certain deductions on their tax forms. Organizing your receipts and invoices allows you to easily know the amount you need to claim each tax season, which ultimately leads to your business saving money. For a modern approach to keeping your financial records in order, read our guide on how to organize receipts electronically, ensuring you’re always prepared for tax time without any hassle.

Can I Claim Expenses Without a Receipt?

In general, a business cannot make a tax claim without a receipt as proof of the purchase. All business expenses you’ve claimed as deductions on your tax return should be supported with documentation, including receipts. A bank or credit card statement is not enough proof of a business expense: the full sales receipt is required.

Conclusion

Although they may seem similar, receipts and invoices perform two very different functions. An invoice, as you’ll recall, is a document generated by a business to request payment for goods or services rendered. Once a business receives payment then a receipt is generated that is also known as proof of payment. A receipt indicates that the purchasing business has transferred the full or partial amount owing to the business that provided the goods or services.

Now that you have a clear understanding of the difference between receipts and invoices, it’s time to get organized! Make a commitment as a small business owner to staying on top of your incoming receipts and invoices. You’ll thank yourself once you discover ways to save money and time during tax season.

FAQs on Invoices vs. Receipts

Is an invoice proof of purchase?

An invoice is not proof of purchase. An invoice merely indicates a business is requesting payment for goods or services provided. A receipt will be issued as proof of purchase once the transaction is partially or fully complete.

Can an invoice be used as a receipt?

An invoice cannot be used as a receipt. This is because an invoice doesn’t indicate that any payment has been made.

What must legally be on an invoice?

Legally, an invoice must include the total charge, the tax amount, and the tax rate. If any tax exemptions have been applied, then the invoice will also have to indicate which goods or services are included in the exemption.

What are the three types of invoices?

For construction or project-based businesses, these three types of invoices are common. The three types of invoices are the pro forma invoice, the interim invoice, and the final invoice. The pro forma invoice is an initial invoice that lays out the rough costs of the goods or services to be rendered. An interim invoice serves as a request for partial payment and a final invoice contains a complete outline of the goods and services provided as well as the outstanding payment amount. There are many more types of invoices, like debit invoices, credit invoices, and recurring invoices.

What should you not put on an invoice?

Invoices are already complicated financial documents. Your accounts receivable department should refrain from adding any unnecessary information, such as confusing notes or alternative requests.

Is a sales invoice valid as an official receipt?

No, a sales invoice is not valid as an official receipt. A sales invoice merely indicates that a certain amount remains owing for past goods or services provided during a business transaction. Only once a customer pays and a business receives full or partial payment will an official receipt be issued.

RELATED ARTICLES

Is an Invoice the Same as a Bill? With Definitions and Examples

Is an Invoice the Same as a Bill? With Definitions and Examples What Is a Sales Invoice? A Small Business Guide to Create One

What Is a Sales Invoice? A Small Business Guide to Create One Is an Invoice a Contract? Create Freelance Contracts to Protect Your Business

Is an Invoice a Contract? Create Freelance Contracts to Protect Your Business How to Make Invoice Number Change Automatically in Excel

How to Make Invoice Number Change Automatically in Excel How to Make a Business Invoice And Tips for Faster Payment

How to Make a Business Invoice And Tips for Faster Payment How to Read an Invoice: The 5 Most Important Things to Look For

How to Read an Invoice: The 5 Most Important Things to Look For