How to Make an Invoice Without a Company

If you’re a freelancer, you might already own your business and not even know about it.

A sole proprietorship is the easiest and most common structure chosen to start a business. It is run by one individual with no distinctions made between you, the owner, and your business. With this unincorporated business, you are entitled to all profits and responsible for all your business debts, losses, and liabilities. This model is typically used for freelancers and independent workers.To become a sole proprietor in the United States of America, you don’t have to take any formal actions. No registration is required and you don’t have to have any start-up funds. As long as you are the only owner, your business starts when your business activities start. You are therefore free to invoice clients as necessary. Once you provide a good and service in exchange for a fee, you can consider yourself a sole proprietor, a business owner, and can create a personal invoice.

This article also includes information about:

- What Should Your First Invoice Include?

- Quick Tips for Smooth Invoicing

- Conclusion

- Frequently Asked Questions

What Should Your First Invoice Include?

Freelancers and the self-employed are responsible for requesting payment for their services. The best way to lay out the details of the sales of your service and calculate the price is to document that information in an invoice to send your customer. Explore our article on how to invoice as a freelancer to craft professional-looking invoices.

Online Invoicing Software

Rather than creating a paper invoice or manual invoices, consider using invoicing software. Invoicing can be made easier with the use of online templates and accounting software. Creating an invoice using a template saves time and hassle. Check out these Freshbooks’ invoice templates that you can use.

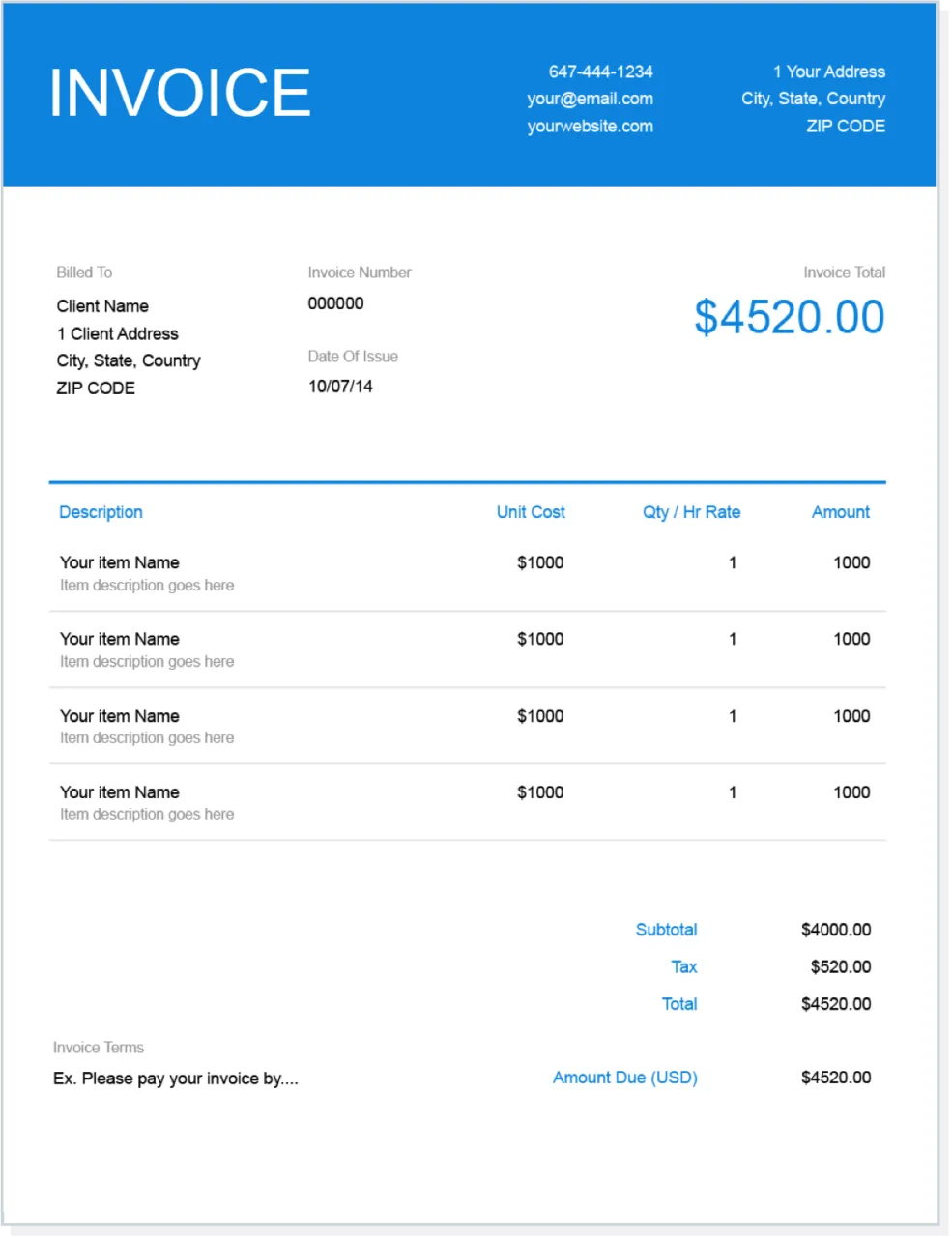

Here are details of what to include on your professional invoices:

1. Professional Header

Your business or full name should be at the top of your invoice in an easy-to-read font. The font on your name should be a little bit bigger and bold compared to all the other text on the invoice.

After your name, you will want to include your contact information, including your mailing address, phone number, email address, and website. Put each item of your business address on a different line to make it easier to read like this:

Company Name

PO Box 12345

Somewhere, US 90319

555-321-7654

To add additional professionalism to your invoice, consider creating and including a logo.

2. Client Contact Information

Next, you will need to specify to who you are sending the invoice to. Below the header include the recipient’s name, address, phone number, and additional contact information here.

Usually, your contact info should be on the opposite side of the recipient information. If your business name and logo are on the top right side of your invoice, your customer’s information should be below on the left side.

3. Invoice Details

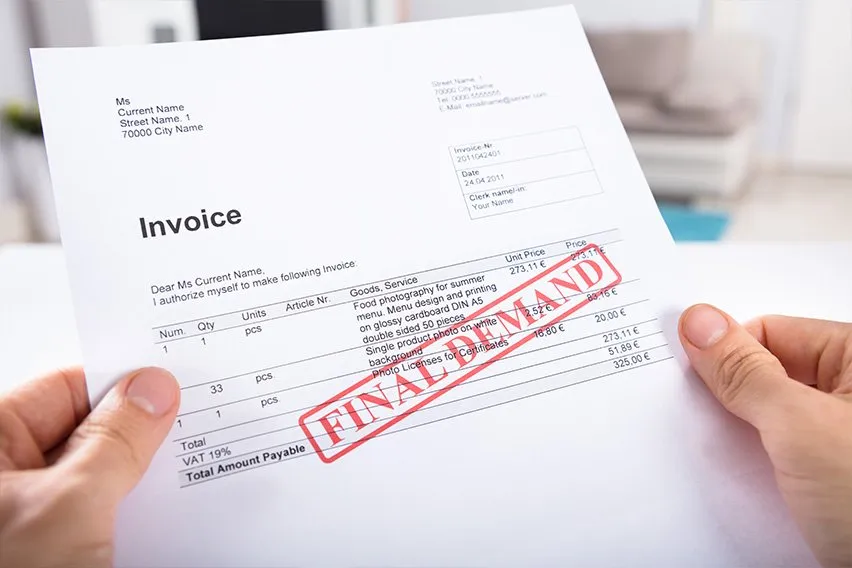

Under your information and across from the client information, include your invoice details. This information is vital for you and your client to keep track of the invoice.

Information to include here is:

- Invoice number

- Date prepared

- Payment date

Make sure the invoice numbering system is sequential, so your tracking is easy.

Invoices usually have a payment date of 30, 45, 60, and 90 days for payment. You can also make an invoice due upon receipt, where the recipient is required to pay as soon as they receive it.

Now, you will need to specify what methods of payment are options that you accept. Do you accept payments through cash, check, credit card, PayPal, ApplePay, etc?

With your payment terms, including details of late fees you may charge for invoices paid past due. This provides an incentive for your customers to pay their invoices on time.

For tax purposes, you might also want to include a tax number here.

Quick Tips For Smooth Invoicing

Invoicing doesn’t have to be a time-consuming part of running your small business. Follow these quick tips for smooth invoicing:

- Practice creating invoices with our free-to-download templates that are available on FreshBooks

- Use the FreshBooks invoicing feature for fast, hassle-free invoicing that looks professional and gets quick results

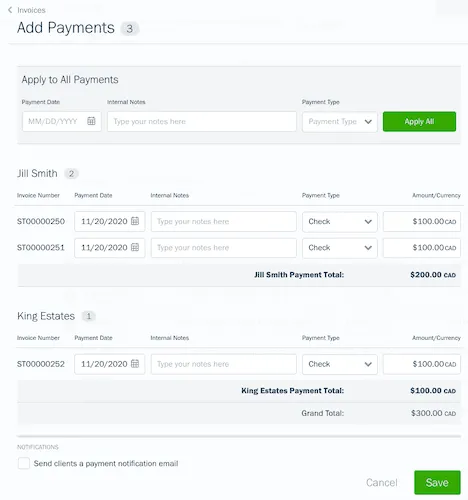

- Using online invoicing software helps you manage invoices and keep information consistent from client to client

- Set up a schedule of payment reminders to be issued automatically to remind clients of past-due invoices

- Set aside a specific amount of time and the beginning and end of your work day to check invoicing including creating new invoices, managing past-due invoices, and tracking payments

Conclusion

Invoicing is a key part of any business, especially a small business like a sole proprietorship or freelancer. You depend on prompt and full payments and need the invoicing process to go smoothly. Luckily, there are many tips, tricks, and tools available to help you manage invoices for your goods and services. If you want to learn how to create an invoice as a sole proprietor, our article on How to Invoice as a Sole Proprietor covers essential steps and best practices for crafting professional invoices

In the U.S., you’re automatically a sole proprietor and are free to invoice clients as necessary as soon as goods or services are provided or agreed upon. As a freelancer or self-employed worker, you are responsible for requesting payment for your services

FAQs on How to Make an Invoice Without a Company

What are the rules for invoicing?

An invoice should include an invoice number, contact info, a description of the goods or services provided, the date of supply, the issue date, the due date, and the total owed. Each state and county has different sales tax laws, rates, and rules, so check local requirements regarding the inclusion of taxes in your invoices.

Do invoices need to be registered?

Invoices aren’t required to be registered or certified to be valid. As long as you are the only owner or freelancer, your business starts when your business activities start. While a physical invoice isn’t always required by law, it’s better for both you and your clients to have a written record of your transactions.

Can I issue an invoice without VAT?

Yes, invoices can be issued without VAT. Only VAT-registered businesses can issue VAT invoices. If you’re VAT-registered, you must issue a VAT invoice whenever you supply standard-rate or reduced-rate goods or services. Businesses, sole proprietors, and freelancers are not required to be VAT-registered and, therefore, should not issue a VAT invoice.

What is the best way to make professional invoices?

Invoice templates are the best way to simplify client billing. When you use a template, you don’t have to worry about formatting or missing any required information. This makes creating new invoices and tracking outstanding invoices much easier.

Can I invoice someone without a contract?

Yes, you can invoice someone without a contract, but it’s generally not recommended. A contract helps ensure that both parties understand the terms of the agreement and can provide legal protection in case of disputes. Without a contract, it may be more difficult to enforce payment or resolve any issues that arise.

More Useful Resources

- How to Make an Invoice

- How to Make a Service Invoice

- How to Make an Interim Invoice

- How to Make a Commercial Invoice

About the author

Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family.

RELATED ARTICLES

How to Invoice a Company: A Step-By-Step Guide for Businesses

How to Invoice a Company: A Step-By-Step Guide for Businesses How to Make an Invoice in OpenOffice: A Step-By-Step Guide

How to Make an Invoice in OpenOffice: A Step-By-Step Guide What Is A Shipping Invoice? A Bill Of Lading Guide For Small Businesses

What Is A Shipping Invoice? A Bill Of Lading Guide For Small Businesses What Is a Sundry Invoice? Definition & Example

What Is a Sundry Invoice? Definition & Example What Is Invoice Reconciliation?

What Is Invoice Reconciliation? Outstanding Invoice: What They Are & Tips To Handle Them

Outstanding Invoice: What They Are & Tips To Handle Them