How to Keep Track of Invoices and Payments: A Guide

Understanding how to keep track of invoices and payments is crucial to the success of your small business. Solid invoice management streamlines the entire invoice payment process, ensuring your company has enough consistent cash flow to pay its expenses. For the best invoice tracking, a company should use a professional accounting and invoice software program.

What should you look for in your invoice tracking software? Cloud backup (or fully in-cloud functionality) is a big one, ensuring you always keep track of invoices should something happen to your files. You should also look for an easy-to-use design that lets you quickly track your expenses, paid and unpaid invoices, bank account details, profits, and more.

If you’re looking to improve your invoice tracking process, we can help. Here are 5 steps to help you keep track of invoices and payments:

Step 1: Research and Choose an Accounting Software

Step 2: Follow Best Practices for Invoicing

Step 3: Follow Up on Invoices the Accounting Software Flags as Late

Step 5: Use the Software to Help Determine Future Financial Strategy

How to Choose Accounting and Payments Software

Step 1: Research and Choose an Accounting Software

A good invoice-tracking software system is a solution for your small business accounting needs, and its features should reflect that.

When looking online at the various accounting software programs available, ask yourself these questions:

Is the Invoicing Software Cloud-Based?

You don’t want a software program you download to your desktop. You want convenience through cloud access, with a program allowing you to enter or access information from your home computer, an app on your mobile device, or anywhere. If you need an offline invoicing tracker, look for one with the option to back up your data to the cloud.

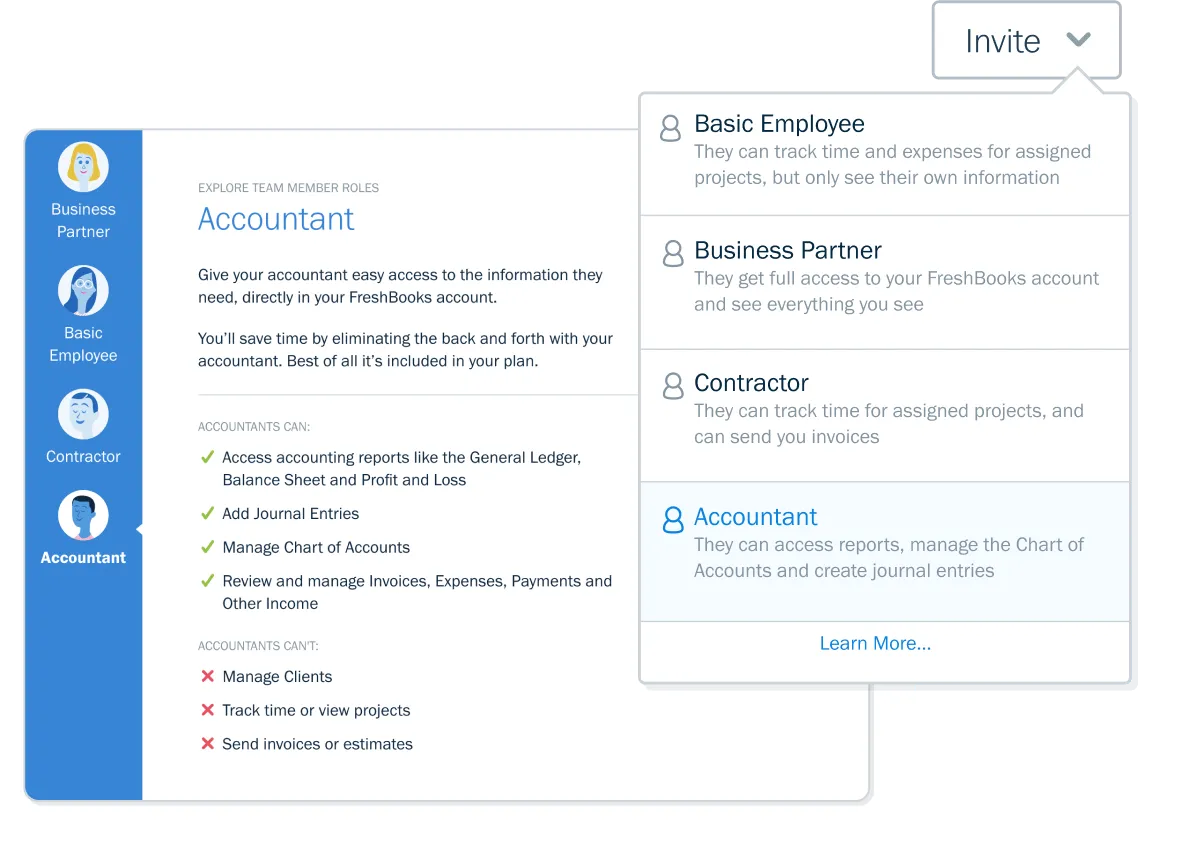

Does the Payment Tracking Software Allow for Multiple Users?

If you’re running a small business, consider letting all staff members enter their expenses. Doing this will save you time or time for the staff member usually delegated to do this task. Ensure the invoicing software allows multiple users and restricts access to certain features depending on the user. After all, you don’t want to share the full financial details of your business with everybody who has a login.

Is the Accounting Program User-Friendly?

Do you understand how to navigate the site? Could you quickly and easily teach it to new users? Also, is the terminology used on the website’s pages understandable only to accounting experts, or will anyone get it? The program should be very, very simple to use in order to make your invoice tracking as efficient as possible.

What Exactly Is the Invoice Management Software Offering?

It’s great if your chosen software allows you to generate invoices and check off payments, but what else can it do? Will it allow you to categorize your expenses? Can you take all the information you’ve entered and do something instantly, like generate a profit and loss report? What are the other extras? For instance, does the software allow you to do up estimates? Will it accept credit card payments from clients? Set up direct deposit to specific bank accounts? Or automatically generate recurring invoices?

Consider all the features (not just the bare necessities of invoice management), and see if they match your company’s needs when choosing your accounting program.

How Secure Is Your Data?

You cannot trust your company’s financial information to just anyone. What kind of encryption and firewalls does the software employ? This security information should be readily available on the company’s site. If you’re not up on the terminology, ask someone knowledgeable on your team to have a look at the available information so you can make an informed decision.

Is the Accounting Software Cost-Effective?

Notice we didn’t ask, “is it cheap?”. Consider the amount of time you’ll spend manually recording transactions or creating invoices, then consider how much time you’ll save when you have an invoice tracking program to do it for you. Weigh the value of that time against all the features the software offers and the monthly price, then decide if it’s worth it.

What Are the Pricing Tiers?

Perhaps someone recommended the software to you and mentioned what they were paying. Maybe the monthly fees sounded like too much of an expenditure for your small business. But consider that most good accounting software programs come with pricing tiers.

Suppose you only have a small client base and minimal accounting needs. In that case, the payment tracking software you’re interested in most likely offers a basic plan with more expensive options for additional features. So, when checking out the various programs, go to the pricing link on the accounting software’s homepage and see if there’s a tier with a price and feature list that will work for you.

Does It Offer a Free Trial?

A free trial is a good way to understand whether the accounting program will do what it promises and if it meets your specific needs. If available, sign up for the free trial and experiment with the features. Load some expenses in, or try their invoice templates. Pretend an invoice has been paid, and see how the system adjusts for that. Generate a report. Ask your staff to play around with the program, too, and get their input before making a decision—after all, they may end up using it just as much as you do.

If you still like a payment tracking software after its free trial and feel confident that it will work for your business, some accounting software programs offer discounts if you pay for the year in advance. Paying in advance is another way to cut costs while ensuring you’re efficiently keeping track of invoices.

Check out the Software’s Reviews

What are small business owners and managers saying about this accounting software? Have they run into unexpected challenges with it? Has it worked out to be easier to use than expected? Reviews are particularly important because reading them will also tell you how the software company’s support team handles user problems.

Step 2: Follow Best Practices for Invoicing

An accounting software program will provide a user template for you to generate invoices. This is particularly handy because the program will always create a new invoice number for you and remind you when payments are due.

However, although this simplifies the process, you must ensure you enter accurate and detailed information every time into the fields provided. When creating the invoice, this may seem like a small detail, but if an invoice goes unpaid, these details could suddenly be crucial. Using invoice software in this can be a game-changer, as It’s designed to meet the unique needs of smaller enterprises, providing them with the tools they need to manage their billing efficiently. If you’re interested in learning more about such solutions, check out our post on the top invoice software for small businesses.

When filling out the fields on an invoice, it is recommended you do the following:

Make Sure the Description Is Detailed

Do not write vague descriptions (e.g., “project as discussed”) under the description section of an invoice, or simply put the client’s purchase order number there (that should go under “Reference”). Be specific. Both you and the client should be able to understand this invoice at a glance, a day or a year from now. Being clear will help your record-keeping for the long term and ensure you don’t have any frustrating situations of trying to investigate vague invoices in the future.

Make Sure the Due Date Is Correct

Often, a program will automatically determine the due date for the payment. Make sure it’s when you really expect payment. If you don’t adjust the due date appropriately, the client’s accounting department will likely go by that incorrect date, possibly delaying payment on your end.

Make Sure Your Contact Details Are Accurate

Perhaps you’ve been using the program for a while, but you’ve moved or changed your phone number. Make sure to update this information across all your invoices in the future. Good invoice tracking software will make this a simple step, ensuring you don’t have to do it for each invoice.

Having all the details as clear as possible on your invoice will help speed up your payment because it will minimize the chance of confusion on the client’s part or the client’s accounting department.

Step 3: Follow Up on Invoices the Accounting Software Flags as Late

Proper accounting software will notify you when a payment is late. Some systems generate and send reminder emails to clients automatically. However, these emails are sometimes ignored or sent to the junk folder by default. That’s when you have to follow up personally.

The best practice for dealing with late invoices is as follows: first, make a courtesy phone call to the client to ask about the payment. If you can’t reach the contact, a follow-up email with the original invoice attached will often do the trick. The client will appreciate that you supplied the invoice and that they won’t have to hunt it down. Doing this helps your client have all the information they need to check on the payment status of your invoice with their accounting department.

Step 4: Run Reports Regularly

Now that you have the software, ensure you maximize its benefit by running regular reports, including a “Profit and Loss Report.” A profit and loss report is a convenient tool as it totals up all the invoices to date (whether paid or unpaid) and then deducts your expenses to give you a net profit total.

Let’s give an example. Mitch’s Mobile Repair is a small store in Niagara Falls, New York. The business is new, having been in operation for only six months. Mitch runs the business by himself and does all the accounting. He does this through an accounting software program. Mitch has diligently entered all expenses and income into the system. Now he runs a profit and loss report.

The report tells him his gross income to date is 180k and his expenses are 120k. His net profit is 60k. From this, Mitch realizes he should probably cut back on a few costs to maximize profit.

In this way, you can see how a profit and loss report would be helpful to a small business owner.

Mitch can also run another report in his program; it’s called “Invoice Details.” It tells him the amount he has invoiced vs. the amount paid. Immediately he can see any outstanding invoices and which companies have yet to pay. Mitch can then follow up on what’s owed.

Step 5: Use the Software to Help Determine Future Financial Strategy

Once you’ve used the program for a while, you will start noticing patterns. There might be expenses that may seem unusually high or invoices that are always paid late. Take notice, and make notes. Create a new financial strategy for the future by deciding if you can cut expenses by doing things differently or if you should change the payment terms for customers who always pay late.

How to Choose Accounting and Payments Software

As you can see, more goes into choosing your invoice data software than the basic functionality. Nowadays, almost all accounting software shares these foundational features, and you should only pay attention to the options that set them apart.

If you’re looking for functional, flexible, yet familiar invoicing software, FreshBooks is just what you need. With professional, automated invoicing services like invoice generation, automated delivery, and automatic follow-ups on late payments, you’ll keep cash flow steady for your business. FreshBooks works just as well for large-scale corporations as it does for your average small business and even works great for freelancers and other independents! Try our free invoice template and see how easy bookkeeping is with FreshBooks on your side.

Conclusion

When searching for your professional accounting software program and determining how to keep track of invoices and payments, there are a few vital things to remember.

Remember to take time with the research portion. Give multiple platforms an honest try. Ask your team members for their input. Experiment with the functionality of each expense tracking software to find something suitable for your needs.

Use your chosen software to streamline and empower the standard best invoicing practices. Consider it a powerful tool to help you get even better at this vital aspect of running a business. Employ as many of the program’s features as possible, and use its insights to help you map out your company’s future.

With the right approach and invoice tracking software or app, keeping track of all your business invoices can be done smoothly, efficiently, and quickly. We have compiled a list of the best invoicing apps that will help you manage and track all your invoices in one place.

FAQS on How To Keep Track of Invoices and Payments

More questions on invoicing software, accounting programs, or anything else to do with your business’ accounts payable and accounts receivable? Let’s have a look at some of the most frequently asked questions.

What’s the most effective way to keep records of invoices?

Gone are the days of the filing cabinet! The best, safest, most efficient way to store invoice data and records is with a secure, cloud-based digital format. Nowadays, most invoicing programs work this way by default. If you are planning to record your receipt digitally,our comprehensive guide offers a streamlined method on how to organize receipts electronically, ensuring your financial documentation is both orderly and easily accessible.

What is an invoice tracker?

An invoice tracker is a key feature in a broader accounting program. It allows you to quickly, easily, and sometimes automatically track the status of every invoice your company sends, like late payments and due dates.

What is a payment tracker?

A payment tracker is similar to an invoice tracker. It allows a business to keep track of the status of each client’s payments, including information on the due date, time outstanding, and late fees of each invoiced amount, usually organized by client and invoice number.

About the author

Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family.

RELATED ARTICLES

What Does a Profit and Loss Summary Tell You?

What Does a Profit and Loss Summary Tell You? How to Read a Financial Report: An Extensive Guide

How to Read a Financial Report: An Extensive Guide How to Increase Profit Margins: Top 5 Ways to Increase Your Small Business’s Revenue

How to Increase Profit Margins: Top 5 Ways to Increase Your Small Business’s Revenue How to Calculate Liabilities: A Step-By-Step Guide for Small Businesses

How to Calculate Liabilities: A Step-By-Step Guide for Small Businesses How to Make an Expense Report: 6 Easy Steps

How to Make an Expense Report: 6 Easy Steps How to Ask for Payment Professionally: With Templates and Examples

How to Ask for Payment Professionally: With Templates and Examples