How to Invoice a Client: 10 Steps to Get Paid on Time

For a healthy business, it’s essential to invoice your clients efficiently and ensure you get paid quickly. This is true across many industries, for large businesses with international clients to independent contractors simply billing for projects.

If you want to get paid faster, you’ll need to create a quality invoicing system. This includes professional-looking invoices, reasonable payment terms, and clear client communication. If you don’t receive payment from a client by the invoice due date, you’ll have to reach out directly to the client about the overdue payment and charge late fees, if applicable.

Explore these topics for tips on how to invoice clients:

What Does It Mean to Invoice Someone?

How to Invoice Clients

Invoicing is a crucial part of small business accounting because it helps freelancers and entrepreneurs get paid faster by their clients. Invoicing clients and keeping track of the record-keeping process can be intimidating if you’ve never done it before.

Follow these steps to invoice clients professionally and get paid on time:

1. Get to Know New Clients

When you enter a business relationship with a new client, research to ensure they’re legitimate. Visit their website to check out their online presence, get to know their business offerings, and see a directory of employees. With new clients, you may wish to charge a deposit upfront to ensure they’re willing and able to pay you. It’s common to charge anywhere between 10 and 50 percent as a deposit, depending on your industry and the project scope—research what other freelancers like you are charging in your area.

2. Understand How Clients Want to Pay

To increase the likelihood of receiving invoice payments on time, get a better understanding of how your clients want to pay you. Be as flexible as you can, within reason. Offer multiple payment methods, like checks, PayPal, credit cards, and cash. Do some research into standard payment timelines in your industry: is it standard practice to offer a 30-day payment window? Offer a payment schedule in line with other businesses like yours and ensures you’ll have enough steady cash flow.

3. Set Your Payment Terms

Once you’ve done some research, establish your payment terms. This includes the methods of payment you accept and the due date for your invoices. Make sure all your payment terms are clearly outlined on your invoices. It’s also good to talk new clients through your payment terms upfront before you send your first invoice.

4. Get to Know the Accounting Teams

If your client list includes larger companies, there’s a good chance that your invoicing contact will be different from your day-to-day work contact. If your client has an accounting team, get to know them and always be polite and friendly in your communication. If you stand out positively, you may be more likely to get your invoices paid promptly, and the accounting team will be more likely to lend a hand if issues or mistakes arise.

5. Create Professional Invoices

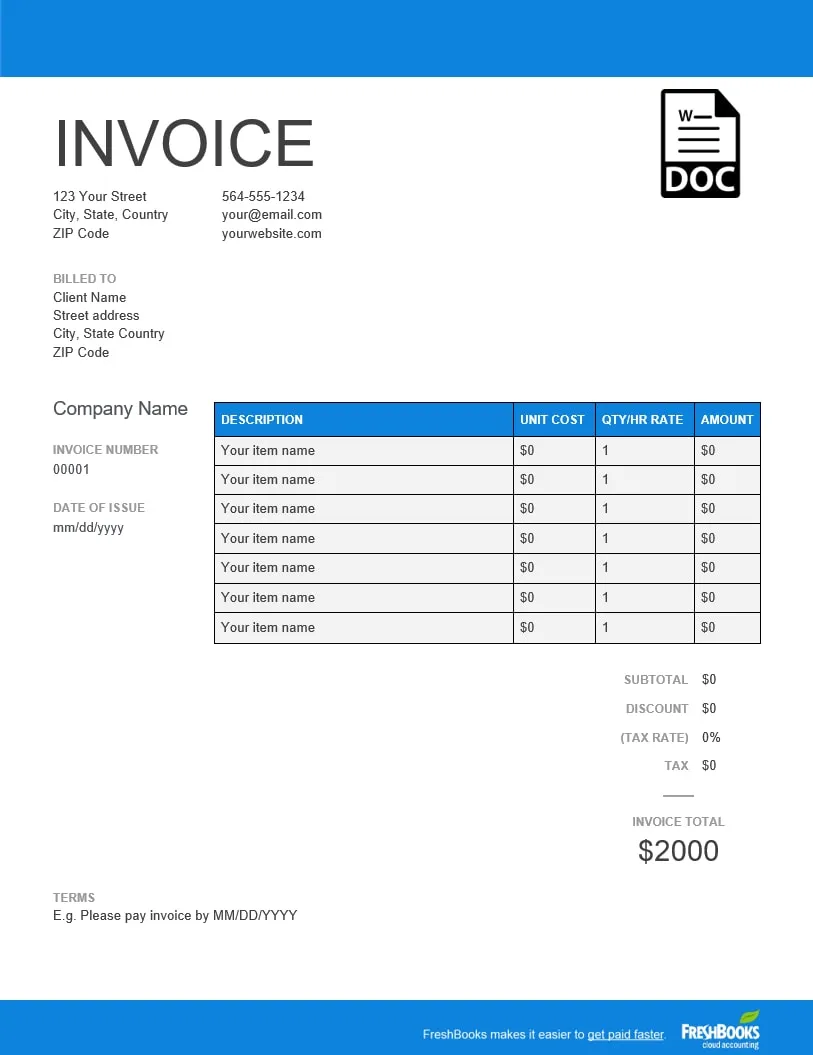

The most critical factor in getting clients paid promptly is sending clean, professional invoices. To do this, you can either use free invoice templates like FreshBooks or pay a small fee to purchase time-saving, cloud-based invoicing software.

Whether you choose to work with an invoice template or one of your own designs, make sure to include all the necessary invoice and business details, including:

- Your business contact details

- Your business name (or other essential details if you are a freelance business)

- Your client’s contact details, with the correct person listed as the contact

- Your company logo

- Your payment terms

- Your method of payment (bank account transfer, cheque, etc.)

- An invoice number and issuing invoice date

- Details of your services

- The total invoice amount due, including any applicable taxes

Check out this complete guide to making invoices for more tips on creating professional invoices to send to clients.

6. Follow Proper Invoicing Etiquette

Always be polite and concise when sending and following up on invoices. Use clear language in your accompanying emails; vague instructions could lead to misunderstandings by the client. If a client is late with a payment, avoid responding in anger. Instead, remain polite yet firm in your communications. If you wish to learn how to effectively request payment from clients politely, we have an article on How to Ask for Payment From Client Through Message. It covers best practices, provides email templates, and will help you craft a professional message.

7. Establish an Invoice Filing System

Once you start sending out invoices, you’ll want to create a filing system so you can easily reference invoices in the future. You may want to create an invoice folder on your work computer sorted by year and then create a naming convention for your invoices that works for you. Or, you can use invoicing software and free invoice templates to simplify the process.

8. Follow up on Unpaid Invoices

If a client doesn’t pay you within the agreed-upon timeframe, don’t hesitate to follow up with a polite reminder that the payment is due. If you don’t get a response to your email, give the client a call and ask for an update on your invoice. It can be uncomfortable to chase clients for payment, but it’s a necessary part of freelance life.

9. Charge Late Fees

Consider adding a stipulation to your payment terms that you will charge late fees on unpaid invoices. If you choose to charge late fees on your invoices, be aware of the maximum interest levels you can charge in your state.

10. Thank Clients for Payment

When clients do pay you on time, be sure to show your gratitude. Send a brief thank-you note for the payment and let them know you appreciate their business. A small thank you can go a long way to securing future business.

What Does It Mean to Invoice Someone?

If you run a small business, you need to collect payment from your clients for your services. Invoicing clients allows you to bill them for your services. Invoicing involves providing clients with a professional document outlining your payment terms, providing a billing date and invoice due date, and itemizing your services and fees.

Invoicing keeps a record of the sale of your service, both for your own records and those of your clients. Invoices are important accounting tools that can help you track your sales and understand how your business grows. If you are not sure how to invoice your clients for services rendered, read our article on invoices for services rendered to ensure accurate financial tracking and maintain transparency with your clients.

What Are Invoices Used For?

Invoices are used for recording sales transactions in accounting. An invoice acts as a bill and lists all the services a business provides to a client.

Small businesses use invoices as a method of getting paid. Invoices provide documentation to clients of the services rendered and outline the terms of payment the client must follow.

Invoicing can be a complex process for newcomers. But thankfully, there are some amazing tools out there to help organize your accounts, get paid faster, and streamline the invoicing process all around. One great example is FreshBooks: a flexible invoicing software that saves you time and helps you get paid.

With countless professional-looking invoice templates available and a suite of software to help you track payments, send automatic reminders that encourage clients to pay quickly, and more, FreshBooks frees you up to do more of what you love.

Click here to Try FreshBooks for Free.

Conclusion

Getting paid promptly is absolutely crucial for small businesses. It ensures a steady cash flow and allows business owners more latitude when making important financial decisions for their company.

Unlike other forms of payment, however, invoicing can come with more uncertainty and inconsistency than you might like. That’s why it’s so vital to educate yourself on these best invoicing practices, as well as to take advantage of all the tools at your disposal. With flexible, powerful invoicing software on hand, you’ll be able to send invoices more efficiently, follow up on late payments more systematically, and get paid faster for your work. If you’re searching for a great option, FreshBooks might be right for you.

FAQs on How To Send An Invoice to A Client

Do you have more questions about invoicing, invoice templates, or how to get paid faster? Here’s everything you need to know to easily handle your own invoices

Can I invoice someone without a contract?

While it’s always preferable to have a signed contract or other written agreement in place, you don’t have to have a contract to invoice a client. While you can still recover owed money without a contract, it’s simpler to have one created—just in case.

When should you invoice your client?

It’s best to send your invoice promptly after your work has been delivered to the client. Though it might seem rude to invoice so quickly, it can help your client remember to pay you, ensuring you’re paid sooner.

Other arrangements might be more suitable for your industry, so discuss options with your client beforehand.

What should you not put on an invoice?

Don’t include your handwriting when invoicing–it can look unprofessional or even lead to accounting errors. Don’t include complex legal jargon regarding payment terms either, keep the language simple and concise. Finally, be sure not to include any errors regarding the date, invoice number, payment method, or client information.

How do I invoice someone if I’m self-employed?

The invoicing process is very similar between self-employed people and businesses. The only major difference is the information in the ‘from’ section. Simply include your name (and business name if you have one), your business address (or your home address), and the usual invoice information.

Alternatively, you can save time by trying one of our free, professional-looking invoice templates for self-employed people.

How long after you invoice a client can you expect payment?

When creating an invoice, it’s up to you to set a payment due date, along with any late fees. The standard is to allow 30 days for payment, although some industries will have shorter or longer periods. Try to give at least 14 days unless otherwise discussed with and agreed to by your client.

About the author

Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family.

RELATED ARTICLES

What Is the Purpose of an Invoice?

What Is the Purpose of an Invoice? 13 Types of Invoices Every Business Should Know

13 Types of Invoices Every Business Should Know How to Make an Interim Invoice | Progress Billing for Small Businesses

How to Make an Interim Invoice | Progress Billing for Small Businesses How to Make a Commercial Invoice: Guide for Businesses with Templates

How to Make a Commercial Invoice: Guide for Businesses with Templates How to Fill out an Invoice | Professional Invoicing Checklist

How to Fill out an Invoice | Professional Invoicing Checklist Invoice Wording: How to Word an Invoice For Your Business

Invoice Wording: How to Word an Invoice For Your Business