What Does an Invoice Look Like: Everything You Need to Know

Whether you’re designing recurring invoices or a one-time payment request, small businesses need to be able to create well-designed and professional-looking invoices. Creating an easy-to-read template using invoicing software may be the easiest method of collecting payments and will reflect well on your brand.

A professional invoice will also help motivate your client to pay quickly, removing the issue of late payments from your business transactions.

Key Takeaways

- Designing a clear and concise invoice can help you get paid faster

- A simple invoice will include the date, your business name and contact information, the customer’s name and contact information, the product or service delivered, and the amount owed

- Noting payment options on your invoice will help you get paid faster.

- Unique invoice numbers will help keep accounts organized and the invoicing process clear, and it aids in efficient communication when referring to specific transactions

Here’s what we’ll cover:

What Does a Professional Invoice Look Like?

How to Design an Invoice

Here are the steps small businesses should follow to design clean-looking invoices that allow you to collect payment on time:

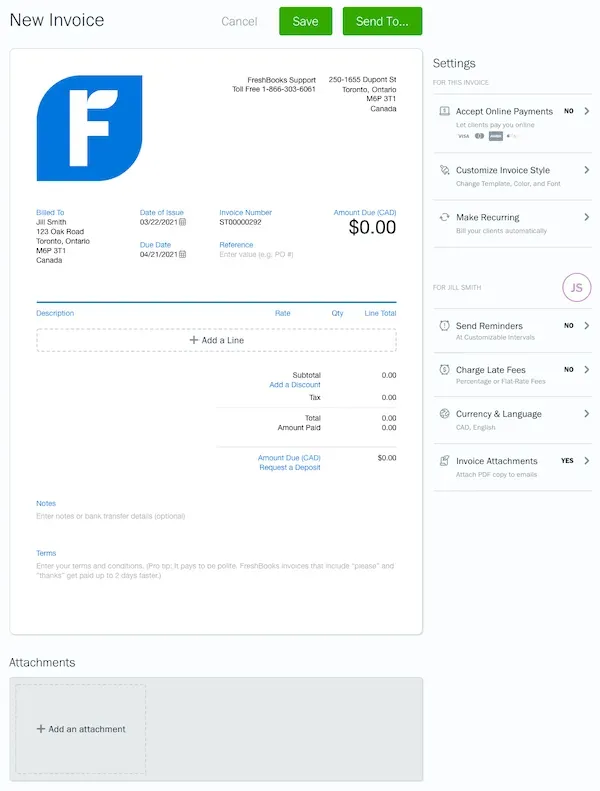

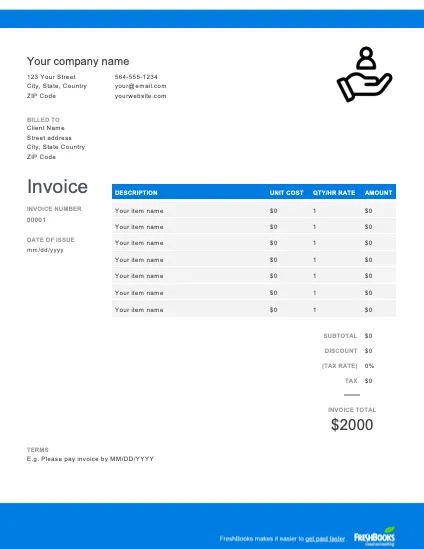

1. Design the Invoice Structure

Take time before diving into invoice design to plan out the structure of your invoice template. You’ll want to design it to fit within the standard margins of an 8.5 x 11” page. Although most clients will leave your invoices in digital format and pay online, you want to make it easy for customers who print out the documents you send them, even for a recurring invoice.Create space for all the essential information you’ll include in your invoice: a header, space for your client’s information, an itemized list of your services delivered, payment terms, and deadlines.

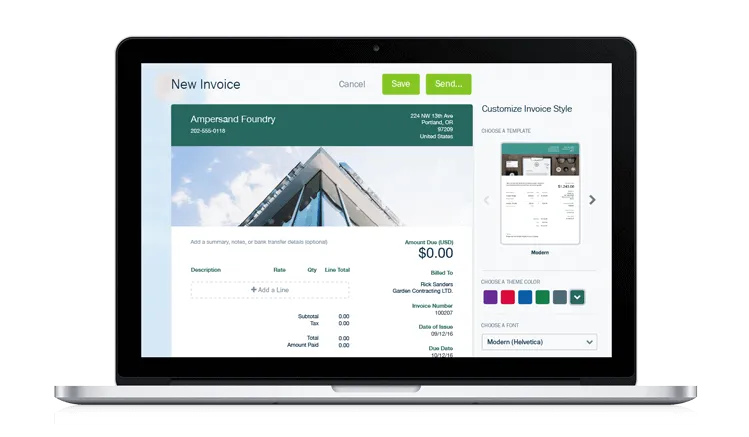

Create professional-looking invoices in minutes with FreshBooks. From building easy, customizable template designs to accepting money online and following up with your client, FreshBooks keeps your business invoicing easy. See the invoicing software to learn more about what our powerful online tools can do for you and your small business.

2. Include Your Brand and Style

What should an invoice look like? The answer depends on your brand. Invoices aren’t just dull business documents; they’re an opportunity to convey the personality and professionalism of your business. This is especially important if you’re in a design-focused industry, like a graphic designer or web designer, but all small businesses should have consistent, professional branding.

If you’re a freelance graphic designer, consider designing your invoice to align with your existing marketing materials. Pay attention to fonts, logos, and branding. If you need further assistance, explore our article on Freelance Design Invoice.

3. Make the Information Readable

The most important element of your invoice design is that it lets the client easily get all the information they need to plan payment. Readability is key. Consider designing a simple grid for your itemized descriptions that include separate columns for each piece of information. Smart use of color can help make the most important information pop from the grid.

4. Leave Room for Descriptions

If you do decide to design your invoice with a grid for your services, you may want to include extra rows in the grid dedicated to your service descriptions, especially if the work you provide is complex and warrants more lengthy descriptions.

5. Make Deadlines and Payment Totals Stand Out

Your invoice amount due and the invoice date are two of the most important pieces of information you’ll include in your sales invoice, as they let your clients know how much they owe and the date by which they need to pay you for your services. If those two pieces of information are clear and stand out from the other information, it can help motivate customers to pay you faster.

It’s a good idea to make both the deadline and total due bold and display them in a large font. You can also create an invoice design that distinguishes this information from the rest of the invoice. Create a sample invoice first to ensure you like how your complete invoice looks.

6. Clearly State Payment Terms

Your payment terms shouldn’t be the most prominent information conveyed in your invoice design, but it’s important to make space in your design for your payment terms. This allows you to state the remittance methods you accept, list out a preferred billing payment method, and outline any late fees you may charge. You can also include a friendly thank-you note with your payment terms to show your clients you appreciate their business.

Invoice Design Theory 101

There are four pieces of information you want to make sure your client notices at a glance when they open your invoice:

- Who the invoice is from

- How much money they owe

- When they need to make the payment by

- Payment options

Everything else in the invoice design is secondary. You may want to treat those three pieces of information consistently to appear cohesive while standing apart from everything else. You can do that by using a consistent font color that contrasts with the background color and making those elements bolder and larger than everything else on the page. Don’t let designing your invoice overwhelm you or take up too much of your time. There are a variety of FreshBooks invoice template styles you can choose from for free in Microsoft Word, Google Docs, Microsoft Excel, and Google Sheets formats. Keep things simple with free invoice templates from FreshBooks.

What Does a Professional Invoice Look Like?

A professional invoice or invoice template has a clean, readable design and conveys all the important information a client needs to make a payment. This includes:

- The business’s name and contact details with a logo, if applicable

- The client’s name and contact details

- An invoice number

- Payment due date

- A detailed description of services provided with quantities, rates, and subtotals

- The total amount due on the invoice

- The payment terms

Conclusion

Invoices are important for communication between businesses and customers, and using one to bill clients will help your business appear more professional. When you create a simple invoice, it not only ensures clarity but also enhances your professional image.

Including your business name (who the invoice is from), how much money is owed to you by the client, when the payment is due, and payment options is all that is needed for a simple invoice. You may also wish to include room for notes, breakdowns of what was purchased, and a unique invoice number. Your client will appreciate a clear and easy-to-read invoice that highlights the important information for them. Many businesses will put the amount due in bold and highlight the due date and payment options to make it easier to understand at a glance.

FAQs on How to Design an Invoice

How to Make an Invoice in Word?

Simply open a new Word document, and type “invoice” into the “Search for Online Templates” field. Press enter, and select the template you want to use. Download the template, and customize the template with information, including your business logo and your company information at the top, along with a unique invoice number.

What Are the Four Types of Invoices?

The four main types of invoices a business will most often use are the sales invoice, the overdue invoice, the interim invoice, and the final invoice. Sales invoices are formal documents requesting payment after goods or services are provided to a client.

Can I Create My Own Invoice?

Yes, creating your own invoice to request payment is easy, and any small business owner can do so using a variety of common computer programs. Many owners prefer to use a simple spreadsheet or Word document. Our step-by-step guide on how to create invoices for small businesses will be handy. For those seeking to download a template online, we offer a Free Invoice Template that can be customized to suit your preferences.

What Shouldn’t Go On An Invoice?

An invoice is an important and legally binding document, so it is imperative that all information provided on an invoice is true and correct. It is good practice to double-check your work to avoid mistakes or mathematical errors. Avoid any misleading or confusing elements, keeping the invoice simple and clear.

Does an invoice need a signature?

Invoices do not need a signature. Typically a Purchase Order or Quote would be signed by the customer as a promise to pay when terms are met on the Quote or PO. Invoices are just the follow-up document when the goods or services have been provided, letting the customer know it’s time to pay and the terms have been met.

About the author

1000 more rows at the bottom Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. In 2022 Kristen founded K10 Accounting. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance.

RELATED ARTICLES

How to Write an Invoice For Services Rendered

How to Write an Invoice For Services Rendered How to Send an Invoice: An Overview

How to Send an Invoice: An Overview How to Create an Invoice in Excel (Template Included)

How to Create an Invoice in Excel (Template Included) Invoice vs Receipt: What’s the Difference

Invoice vs Receipt: What’s the Difference Is an Invoice the Same as a Bill? With Definitions and Examples

Is an Invoice the Same as a Bill? With Definitions and Examples What Is a Sales Invoice? A Small Business Guide to Create One

What Is a Sales Invoice? A Small Business Guide to Create One